REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

This Week’s Big Story: Does the Eid Holiday Predict Future Capacity Issues?

Our expectations were that April would be a month with little to no disruption, capacity would be ample, and rates would fall. Rates have fallen — in fact, the National Truckload Index Linehaul Only (NTIL) has dropped from $1.67 on April 4 to $1.61 as we write this. But we’ve been surprised by the amount of disruption caused by the Eid holiday.

Eid, which marks the breaking of the 30-day fast of Ramadan, is celebrated by Muslims around the world, and it usually takes drivers off the road who celebrate. In some hot markets, this hasn’t had a big impact, as some drivers opted to stay on the road to generate revenue. Heading into this holiday, we assumed there was enough capacity to handle Eid without strategic shifts in our business.

As it turned out, key markets that haven’t experienced capacity issues — including Wisconsin, Minnesota, Texas, Chicago, New Jersey and Maryland — immediately tightened. This forced us further down waterfalls and further into transactional sourcing than we had been since the inclement weather that struck near the Martin Luther King Jr. holiday in January.

This tightness loosened by Thursday, after the Eid holiday had ended. But the fact that we saw this kind of immediate capacity tightening based on a subset of capacity — owner operators and smaller carriers — leaving the road is significant. It makes us believe that the current capacity environment is far more depleted and fragile than we thought heading into 2024.

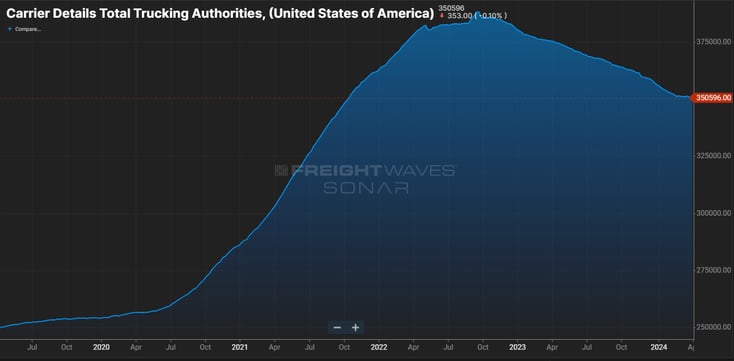

When looking at carrier authority numbers, we still have way too many authorities in the market. But we’ve now shed ~30K authorities since the end of 2022. It’s important to remember that authorities enter the market with just a few trucks, and exit with more trucks — so the capacity lost is far greater than authority numbers would suggest.

In addition, we reject the idea that capacity is meaningfully growing, as indicated by the recent BLS data on Seasonally Adjusted Long Distance TL Employment, which showed February gaining 700 jobs and rising to 545.5K total employees. Looking at the non-seasonally adjusted numbers, we see that February was pretty much flat, with January at 540.1K employees, and this measure remains at the lowest level since May 2022.

In short, while demand remains an open question, our view on capacity is becoming more and more clear. Enough drivers have been removed that either traditional volatility — including CVSA’s International Roadcheck on May 14-16 — or increasing demand will overcome the current levels of capacity, and we’ll see immediate pressure on contract routing guides. Short-term pressure will raise spot rates until volatility eases, but repeated events could put more significant pressure on service levels.

What’s going on with Economic Indicators, Demand, Capacity and Markets this week? Keep reading to find out.

Watch This Week's Redwood Rundown

Posted weekly, the Redwood Rundown showcases insights from Redwood’s resident expert, EVP of Procurement Christopher Thornycroft. Spend just a few minutes with Christopher to gain a deeper understanding of the events impacting your business this week:

This Week’s Economic Indicators

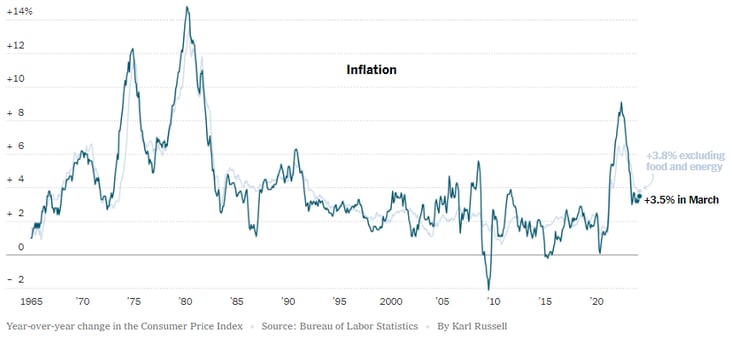

The Consumer Price Index was released for the month of March, showing a stronger-than-expected reading of 3.5%. Core inflation, excluding the more highly volatile food and energy data, increased by 3.8%. The pace of declining inflation has seemingly hit the floor over the last few months. This is delaying the timeframe for the Fed’s target of 2% inflation as a trigger for reducing benchmark interest rates. Our expectations are that there will likely be no rate cut the next time the Fed meets.

New housing starts have remained resilient against the highest interest rates in a generation and are a vitally important bellwether for freight volumes. If higher interest rates continue, however, they will limit the ceiling on new housing starts.

Demand Trends for this Week

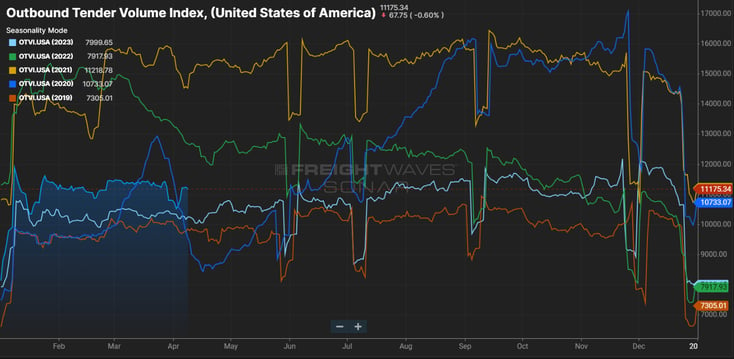

The Outbound Tender Volume Index (OTVI) stands just north of 11,100 and remains stronger year-over-year (YoY), though more freight continues to hit private fleets rather than for-hire fleets, despite the large cost difference.

The Inbound Ocean TEU’s Volume Index (IOTI) stands just below 1500, but has not surged yet. Current forecasts for H1 2024 project +11% gains over H1 2023.

The Outbound Tender Rejection Index (OTRI) fell to start the week, then rebounded quickly to 3.75% on Eid-related tender rejections. Tender rejections are up 30% over 2023’s weak comps.

Capacity Trends for this Week

The number of total trucking authorities decreased again in April, down -353 to 350,596. Anecdotal reports of carrier failures have increased as well, and failures are beginning to be seen in the mid-sized fleets.

As mentioned earlier, February’s Long Distance Truckload employment numbers were updated, with seasonally adjusted employment up +700 employees in February to 545.5K. Non-seasonally adjusted employment stands at 540.1K, which represents a -9.8K drop-off in employment since December.

Regional Market Trends for this Week

We’re a third of the way through April, and the US freight market has been unseasonably tight in pockets throughout the country.

Eid al-Fitr took place the night of Tuesday, April 9, which impacted capacity throughout the Midwest more than expected. The Midwest is otherwise in its seasonal trough this time of year, and we expect things to remain cool out of the region the rest of the month.

As we stated last week, the Texas and the Mexico border markets begin to heat up this time of year with produce imports. We’ve already felt market pressure along the border, as well as in the Houston market, to begin the month.

Southern California has remained relatively flat, but we still expect volumes to pick up heading into the month of May. Produce will hit the Imperial Valley, impacting the Los Angeles market, beginning in early May — while summer retail season will push seasonal import volumes higher for the region.

The Southeast remains the market with the highest seasonal volatility in April, traditionally beginning in South Florida. Inbound rates will continue to fall for Florida as they continue to be more and more desirable.

The Vidalia onion packing date is April 17, which will immediately impact South Georgia’s capacity.

The Pacific Northwest continues to remain a backhaul market, with high contract load acceptance levels and little available spot freight outbound.

An Update on the Port of Baltimore

The reverberations of the Francis Scott Key Bridge collapse continue. While huge efforts are under way to clear a path for container ships, the estimated timeframe remains an open question. The US Army Corp of Engineers has estimated that full access may be available by May.

Top 3 Charts for the Week

Are We Headed for a Capacity Shortage?

As the market tightness around the Eid holiday demonstrated, continued carrier exits may lead to capacity issues.

The OTVI Is on the Rise

The Outbound Tender Volume Index (OTVI) is over 11,100 and looks strong YoY. But we’re seeing more freight go to private fleets.

Inflation Increased in March

As inflation continues to rise, it seems unlikely that the Fed will cut benchmark interest rates anytime soon.

Get Up to Speed with Weekly Market Intel

Learn about the market trends impacting your business by following the Redwood LinkedIn page to catch our Redwood Rundown videos. And keep monitoring our insights blog for these weekly deep dives!