REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

Over the past few weeks, our view on the market has revolved around the looming UAW strike against the Big Three Detroit auto giants — General Motors, Stellantis (formerly known as Chrysler), and Ford Motor Company. As another week has gone by, a strike looks all but imminent as the two sides remain miles apart and the unique timing of a strong labor market and a rapidly changing auto industry comes head-to head.

Other forces affecting the US logistics market? As carriers see their 18-month hiring spree reach an end in October, the OTRI is going to rise and capacity is going to shrink. That means higher rates and potentially lower service levels for US shippers over the next six- to nine-month period. As Q3 winds down, shippers and carriers alike are readying their Q4 contracts. Typically we’d see the end of the quarter placing pressure on brokerages, but the events in Detroit are creating uncertainty across the market.

It’s a big week for the US freight market. Read on for more details.

Each week, EVP of Procurement Christopher Thornycroft shares his expert perspective on the US logistics industry in the Redwood Rundown. Watch this video to quickly gain a deeper understanding of the events and trends impacting your business this week:

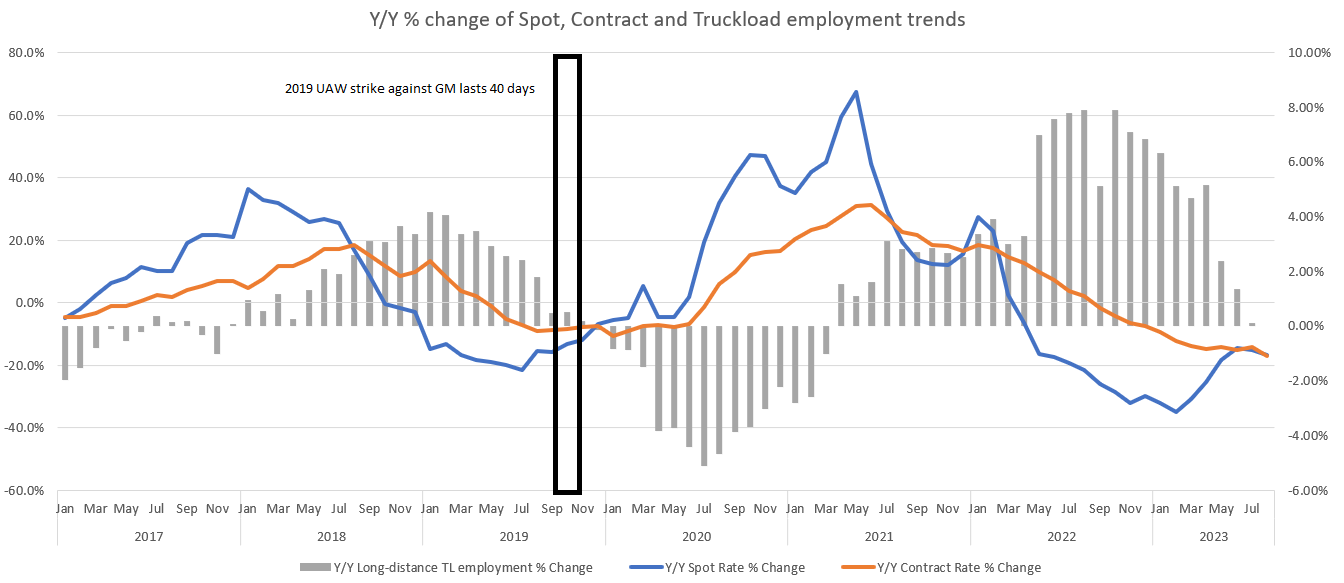

What are the likely implications of the impending UAW strike? Let’s look to recent history for the answers. In 2019, the UAW strike targeted General Motors, with 48,000 workers picketing at a staggering 50 locations nationwide. Fast forward to today, and the potential production disruption could be three times as severe, affecting 146,000 employees across all the Big Three automakers. For the freight market, the 2019 strike coincidentally hit at the same point in the freight cycle that we are in now. As we largely bump along the bottom of this current cycle, carriers are in their most financially vulnerable place since fall 2019. A prolonged strike will see short-term volumes collapse from the US/Mexico border up into the Midwest, and we will likely see continued rate pressure, as larger fleets are forced to load boards and brokerage freight to continue moving equipment.

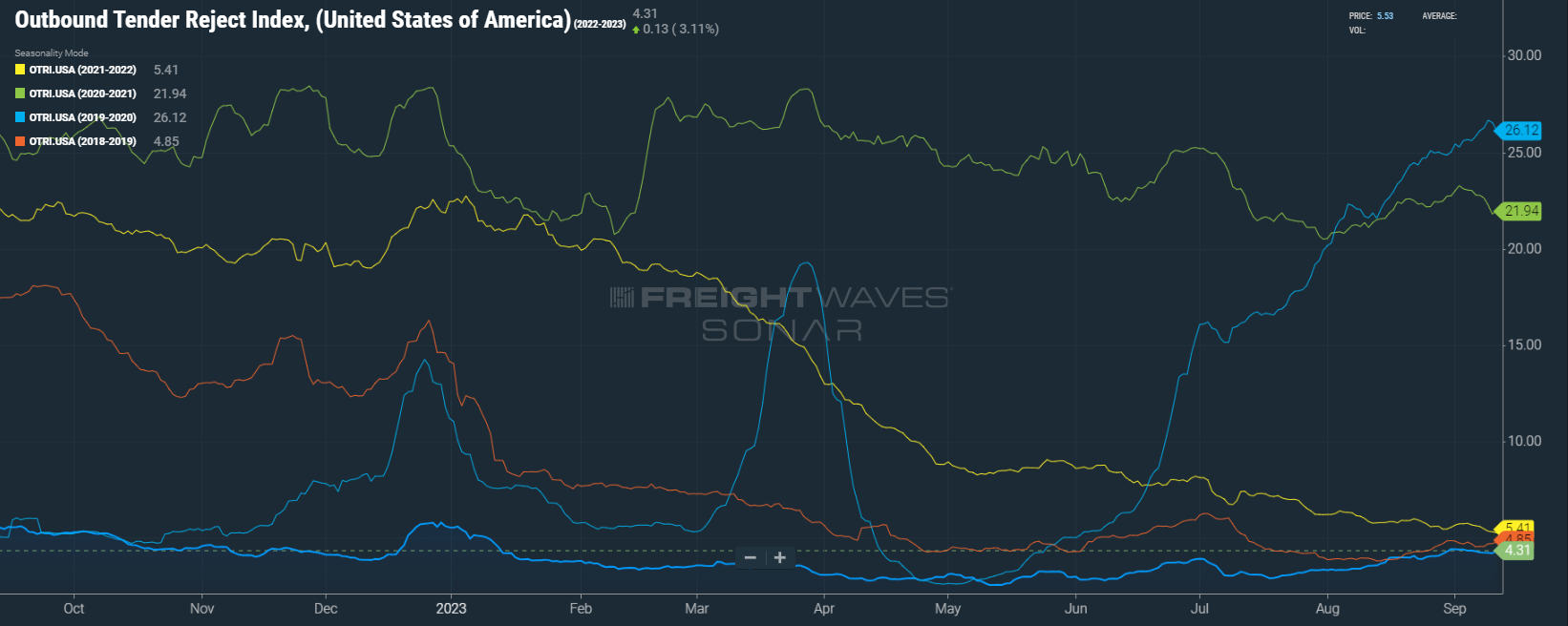

In addition to the upcoming strike, carriers face other pressures. The hiring spree that carriers have enjoyed over the past 18 months has come to an abrupt halt, with October poised to see negative year-over-year growth. This is not good news for shippers. As carrier capacity diminishes and return trips from still-lucrative contract freight move below the cost to operate, contract rejections — as measured by Sonar's Outbound Tender Rejection Index (OTRI), currently at 4.31% — will steadily rise in the coming months. This will provide the remaining carrier capacity with more flexibility and opportunity for spot freight opportunities in 2024. When we reach this point in the market cycle, shippers should expect to see either smaller commitments from enterprise-level carriers on contract freight, or diminishing service. Despite the historic spread between contract and spot rates, declining contract rates will push carriers past their break-even point. This is not a matter of “if”, this is a matter of “when” it will happen. We’re currently projecting six to nine months, but possibly sooner depending on the impact of current market events. Shippers are feeling this, too, as there has been a notable pivot away from short-term bids back to longer-term bids, as shippers sense the current cycle is ending.

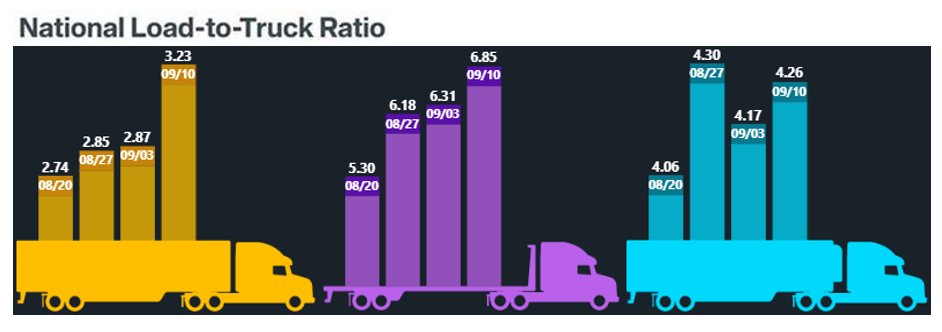

In market specifics, we’re in our typical September mid-month lull. Post Labor Day repositioning has largely been resolved, and carriers and brokers are scooping up valuable contract freight ahead of new awards beginning in Q4. There has already been a noted decrease in capacity that is now pushing the market past equilibrium; however, one week does not drastically change the market. Typically, the market needs to see multiple weeks of sustained pressure on service to pivot from trough-level rates to sustained spot increases, with those sustained spot rates and volume increases taking six to eight weeks to begin to put upward pressure back on contract rates. While the UAW strike impact blurs the picture, typically we would see the end of Q3 bring a real squeeze for brokerages.

Many of the projections in this week’s Redwood Report will be affected by what happens in Detroit over the next few days. All of us need to adopt a “wait and see” attitude, as a UAW strike represents a critical event in the freight market that has the potential to impact a longer-term timeline.

The 2019 UAW strike against GM lasted 40 days, and it had a huge impact on US freight market supply and demand. The looming strike involves all three automakers and three times as many employees.

As carriers see their hiring spree wind down, the Outbound Tender Reject Index (OTRI) is expected to only rise in the coming weeks.

Data used with permission from Freightwaves.

The national load-to-truck ratio reflects this week’s trends in available capacity and rejection rates.

Data used with permission from DAT Freight & Analytics.

You can watch Christopher Thornycroft’s insightful Redwood Rundown video every week by following the Redwood LinkedIn page. Our insights blog is another great way to learn about industry trends and gain intel, including the weekly Redwood Report and other news!