REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

Welcome to mid-October and the fourth week of the United Auto Workers (UAW) strike. Traditionally we would see the US freight market remain soft through the month of October, with a light heat-up at the end of the month. We expect the same, but softer this year. Across the country, freight volumes remain scarce, and rates aren’t moving upward. Capacity continues to exit the market, and long-distance trucking employment is down 59% since this time last year. We haven’t seen capacity shrink like since 2019, when a UAW strike targeted General Motors. We expect capacity exits to accelerate as we head into 2024. However, it’s important to note that the week beginning November 27 is not that far away. No matter how soft the market is, capacity will naturally tighten as capacity is dislocated after the Thanksgiving holiday. Smart shippers will start planning for this now.

Read on to learn more, including a closer look at regional dynamics.

Watch This Week's Redwood Rundown

Looking for an expert perspective on the US logistics industry? Join Christopher Thornycroft, Redwood’s EVP of Procurement, for the weekly Redwood Rundown. In just a few minutes, you can learn more about the news, events and trends that are sure to impact your business:

Employment Drops Sharply — and Capacity Continues to Leave the Building

Low volumes and low rates in spot markets continue to force capacity out of the US freight market. Without even pocket surges of demand, oversupply is sure to persist. That creates a cycle where rates will remain low, and capacity will exit at an even faster pace. The August numbers were released last Friday for Long Distance Truckload Employment, and we’re seeing the long-expected first month of year-over-year decline — a shocking 59% drop since August 2022.

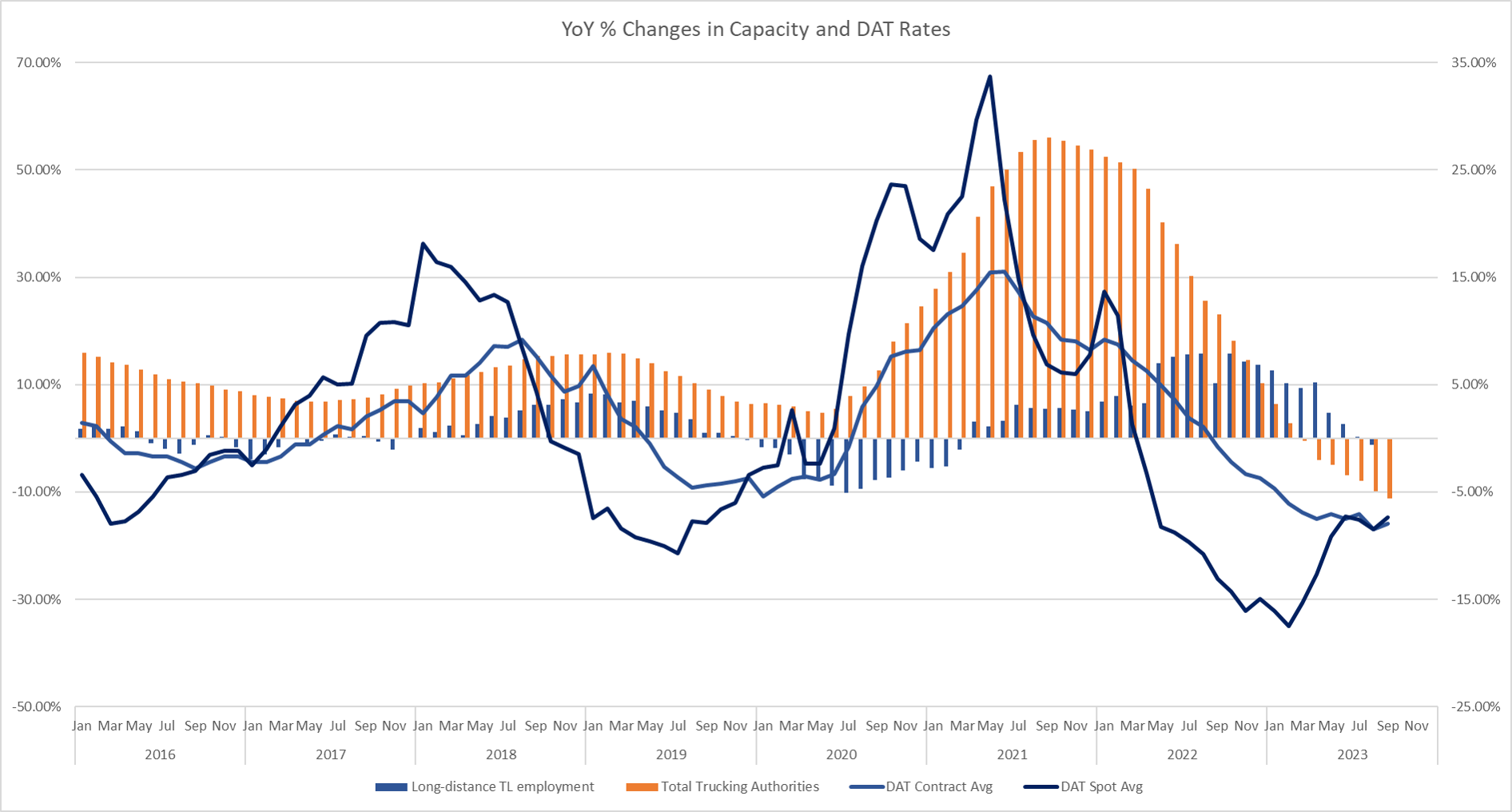

Over the last two years, we’ve witnessed an explosion of capacity that has oversaturated the US market, leading to an 18-month “race to the bottom” on rates. The surge of new trucking authorities in 2020 and 2021 slowed growth for employment in enterprise-level fleets until March 2022, when the Russian invasion of Ukraine shot oil prices to the moon. This sent smaller owner-operators toward the safety of enterprise carriers, who were able to buy fuel at a discount. Since then, we’ve seen a declining spot market due to corrected routing guides and the surge in enterprise capacity.

However, we’re now at the point where enterprise-level capacity is in year-over-year decline as well. The last time we saw enterprise capacity beginning to shrink like this was in late 2019, when a 40-day UAW strike targeted General Motors. As the current UAW strike enters its fourth week, the enterprise-level carriers that dominate contract volumes for the Big Three Detroit automakers have flooded the spot market with capacity, along with rates that run well below the operating levels of any owner-operator. As both smaller carriers and enterprise fleets fight over spot volumes, we expect to see capacity exits accelerate heading into 2024.

An Early Cold Spell Hits the US Market

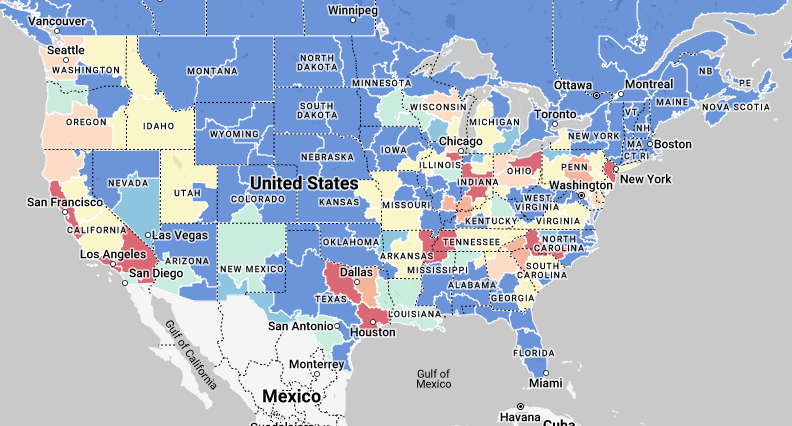

In market specifics, volumes are largely down across the country. In one bright spot, the Pacific Northwest (Seattle 3.0 to 1 and Portland 3.9 to 1) is in the middle of its seasonal produce season, with volumes up across the region. However, down south in Los Angeles (4.8 to 1), volumes have are rapidly declining post end-of-quarter, as imports stayed relatively flat ahead of holiday imports hitting the area. We expect the rest of the Southwest to continue to fall off for the remainder of October. The Mid-South has also seen volumes collapse, particularly along the US-Mexico border (Laredo 2.9 to 1), as auto imports have ground to a halt. Volumes remain low throughout the rest of the region, stretching from Dallas (1.9 to 1) to Memphis (3.3 to 1). Southeast volumes continue to fall as Atlanta (1.5 to 1) and the rest of the region remains in its seasonal lull. Up in the Northeast, volumes have fallen each week from Elizabeth, NJ (2.9 to 1) to Harrisburg, PA (2.6 to 1). The Midwest is typically in its peak season, but the UAW strike has hit hardest in this region. Major markets from Chicago (1.7 to 1) to Minneapolis (2.2 to 1) and Columbus (1.9 to 1) are all flush with capacity.

Waistbands Aren’t the Only Thing Tightening After Thanksgiving

While the market is soft, it’s worth noting that the week beginning November 27 represents the point where the market will see a true tightening. Shippers will be resuming activity with their capacity highly dislocated following the slow pace of Thanksgiving week. This disruption will tighten the market, regardless of current conditions. The last week of November is a long way off, but in the world of logistics we mark that date on the calendar — and remind everyone that it’s never too early to start planning for it.

Top 3 Charts for the Week

Long-Term Freight Market Supply and Demand Trends

Taking a look back, it’s easy to see the effects of the UAW strike against GM in late 2019. We’re experiencing similar effects today as we enter the fourth week of the current UAW strike.

Hot Markets Aren't So Hot

The freight market remains cool to cold across the country as the UAW strike continues.

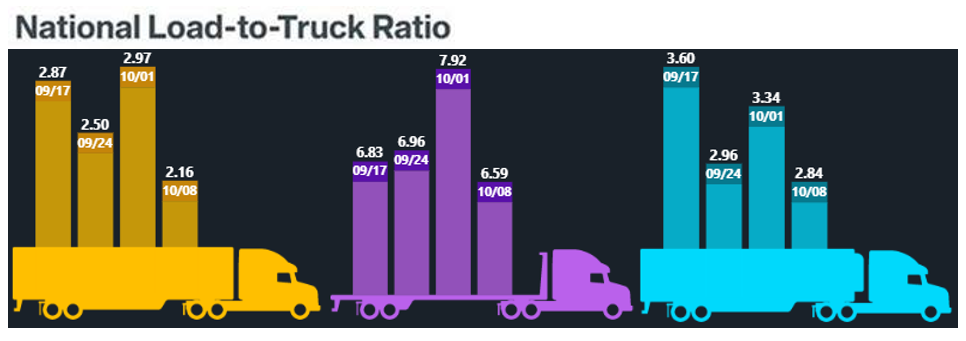

DAT National Load-to-Truck Ratio

The load-to-truck ratio fell sharply last week, from 2.97 to 1 to 2.16 to 1.

Data used with permission from DAT Freight & Analytics.

Get Up to Speed with Weekly Market Intel

Follow the Redwood LinkedIn page and gain critical insights by watching Christopher Thornycroft’s Redwood Rundown video every week. And check out our insights blog to access the weekly Redwood Report and other news updates.