REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

Heading into the Labor Day weekend, there’s one big force impacting the US freight market — and its name is Idalia. As this hurricane cuts across a large part of the Southeast, we can expect the typical holiday transportation volumes to be augmented by disaster relief shipments. Adding to the volumes? It’s the end of the month, so shippers are pushing their freight out the door to get it off their books for August. The result is the most volatile logistics market since December 2022.

Read on to learn more about the logistics turbulence we can expect in the wake of this storm and in the aftermath of the Labor Day holiday weekend.

Every week, EVP of Procurement Christopher Thornycroft provides his expert perspective in the Redwood Rundown. Take just a few minutes to learn more about the events and trends set to impact your business this week:

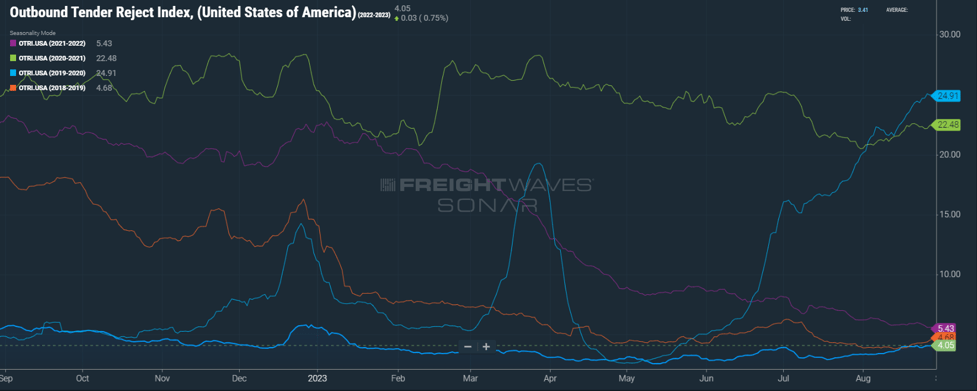

There’s never a good time for a hurricane, but the pre-Labor Day landfall of Idalia is particularly disruptive for the logistics industry. The storm is covering a large region, which creates the need for widespread disaster relief — just when the industry was already gearing up for holiday volume increases. When combined with end-of-August shipments, we expect to see the most volatile market since late December 2022. The Outbound Tender Reject Index (OTRI) currently stands at 4.15%, the highest level since January. The OTRI measures how much contract freight is rejected, and each rejection means spot opportunities for carriers. The rising OTRI is a good sign for opportunistic carriers, especially after 18 months of declining rates and shrinking capacity.

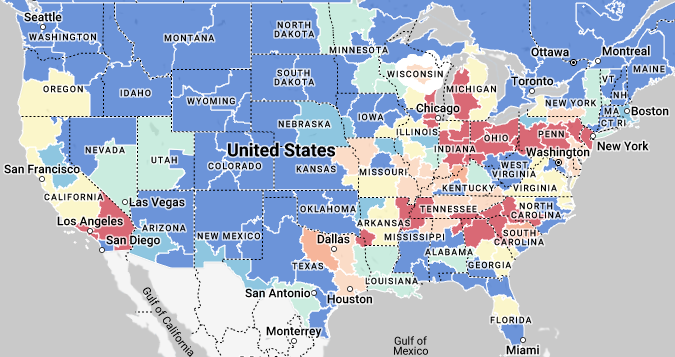

Shortly after Idalia arrived, we began to see immediate impacts for the transportation industry in the Southeast US. Inbound rates to Florida skyrocketed overnight. Rates will remain elevated for the foreseeable future into Florida, Georgia and South Carolina as the demand for relief loads will greatly outweigh any amount of outbound freight from the region. This will bring a shock to routing guides ahead of Labor Day, as well as after the holiday.

Unfortunately, the disruption caused by the holiday and the hurricane will continue to impact the US logistics market for some time. We can safely assume that capacity will be imbalanced throughout all of next week. Equipment repositioning will add to the disruption as trucks are not where they need to be to haul contract loads. The high rates that shippers are willing to pay this weekend may serve as “blood in the water” for carriers hungry to regain some of the profitability they’ve lost in the last 18 months. Expect them to ride this wave of disruption for as long as they can.

The Outbound Tender Reject Index (OTRI) is on the rise, as contract carriers reject more loads and spot carriers seize the opportunity. Decreasing freight capacity nationwide is placing more power in the hands of carriers.

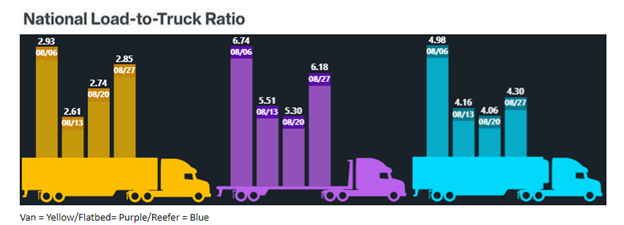

Supply-side pressures also continue to impact the national load-to-truck ratio. We’ll be watching for even more increases in the wake of Labor Day and Idalia.

Data used with permission from DAT Freight & Analytics.

The Southeast US is expected to be the focus of disaster relief efforts. But other areas of the country are also seeing high transportation demand as we head into Labor Day weekend.

Eager to learn about the news and trends impacting your business? Simply follow the Redwood LinkedIn page and watch Christopher Thornycroft’s insightful Redwood Rundown video every Tuesday. And keep an eye on our insights blog to stay current with the Redwood Report!