REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

As we approach the Labor Day holiday, many forces are shaping the logistics market. Demand is growing, but so are fuel expenses and other costs. There’s been an abundance of capacity, but that may be changing as pre-holiday shipping volumes increase. Labor negotiations between the UAW and the Big 3 Detroit automakers have the power to upend both the overall US economy and the freight market unless a deal is reached quickly. A devastating hurricane just struck California, and another is headed for Florida.

Read on to learn more about how these developments are impacting the logistics landscape.

Watch This Week's Redwood Rundown

Want to take a quick look at the events and trends that will affect your business this week? Watch the Redwood Rundown, where EVP of Procurement Christopher Thornycroft provides his pre-Labor Day insights.

Labor Day Market Trends

Even as diesel fuel costs have risen +$.485 from July averages, spot rates are refusing to budge. As a result, the OTRI is rising steadily as capacity declines. Up until this point, high contract rates were enough to keep plenty of carriers running, but the continued downward pressure on rates has been gradually pushing capacity out of the market. While we continue to see demand at its highest point since October and early November of 2022, there has still been a surplus of capacity. However, the pre-Labor Day push of volume, particularly in the Midwest and Northeast, will stress that capacity and lead to increased spot activity — and a lift in spot rates.

Is an AUW Strike Looming?

The US logistics industry should be carefully watching the labor negotiations between the UAW (United Auto Workers), with its 150,000 members, and the Big 3 Detroit automakers. Negotiations have not progressed well, with the two sides remaining far apart on compensation, hours and benefits. With a September 14 negotiation deadline approaching, we should prepare for a strike that will have an immediate impact on the overall economy and the freight market, with excess capacity in the Rust Belt.

As We Brace for Idalia, a Look Back at Hillary

As Idalia sets its sights on the Florida coastline, we’re still trying to understand the full impact of Tropical Storm Hillary on Southern California. Early indications are that the most critical damage was avoided. The SoCal market generally sees a massive spike in demand beginning the Wednesday before the Labor Day holiday, and we still expect this to be the case. The region does not look like a market driven by disaster relief. Nationwide, we will see some disruption following the holiday weekend as drivers will be reluctant to return to work, trucks will need to be repositioned, and carriers will be forced to give up their spot rate increases.

Top 3 Charts for the Week

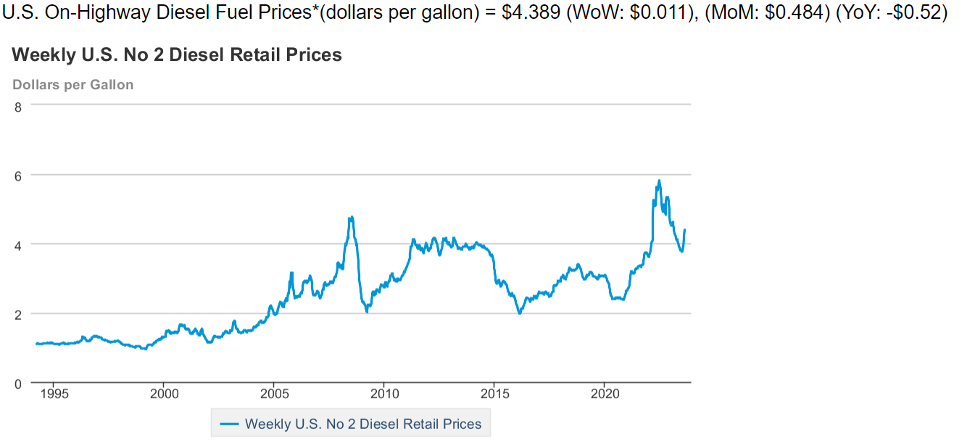

Fuel Cost Trends

The rising cost of diesel fuel is putting huge pressure on carriers who have already been operating 15-17% below their cost to operate on spot freight for months now.

DAT National Load-to-Truck Ratio

Like the OTRI, the load-to-truck ratio is increasing due to supply-side pressures. The DAT load-to-truck ratio moved up to 2.74 to 1 last week without any notable pressure on the market.

Data used with permission from DAT Freight & Analytics.

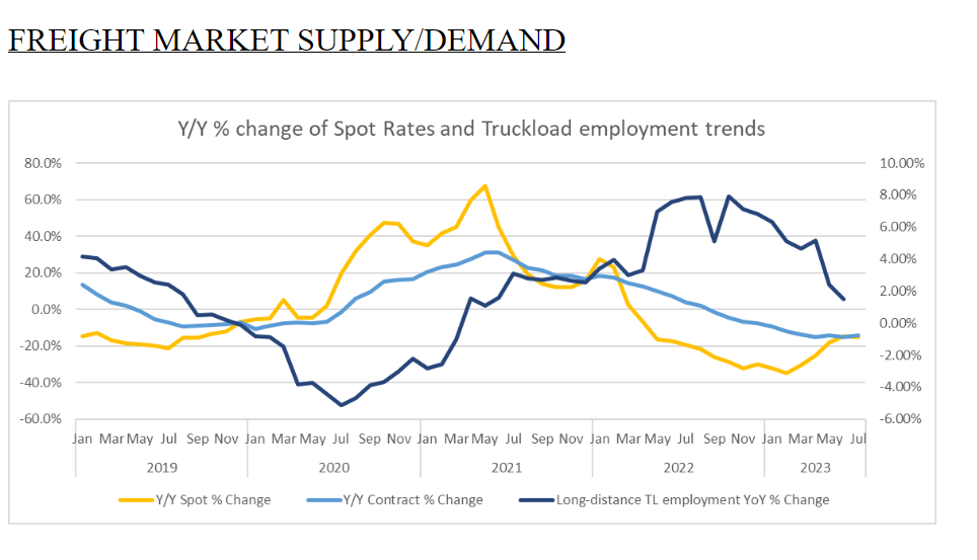

Freight Market Supply and Demand

As the freight market moves closer to equilibrium, critical events and holidays like the Labor Day weekend will have a greater potential impact than in previous months.

Get Up to Speed with Weekly Market Intel

Learn about the market trends impacting your business by following the Redwood LinkedIn page to catch our Redwood Rundown videos on Tuesdays. And keep monitoring our insights blog for these weekly deep dives!