REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

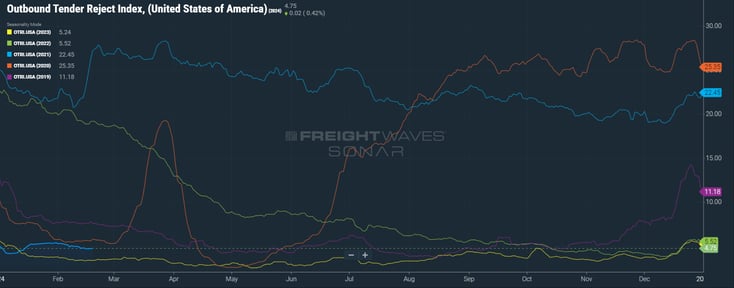

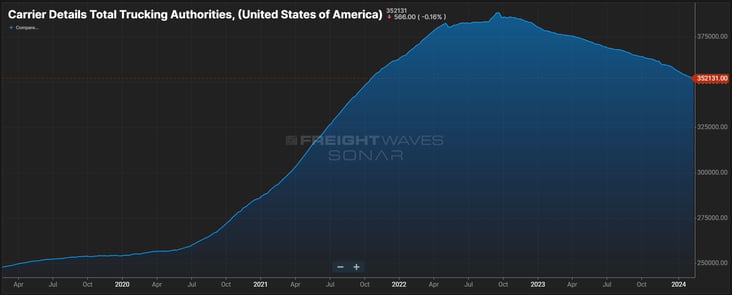

While we remain in low-volume February, the CLAV (Contract Load Accepted Value) — which is essentially the OTVI (Outbound Tender Volume Index) without tender rejections — is +7.6% year-over-year (YoY). At the same time, carrier authorities have contracted by -5% YoY (-18,887 authorities). And the OTRI (Outbound Tender Rejection Index), even in this low-volume environment, is up 41% YoY (increasing from 3.28% in 2023 to 4.64% in 2024).

While the rate environment is down -4% YoY, the previously mentioned relationship between volume/capacity/tender rejections points to a tighter-capacity environment in 2024 — and a stair step of cost increases likely to come with increased volume gains.

As low as rates are right now, they’re still behaving very much within the typical patterns of market seasonality. Currently we’re projecting volume to rise by the end of February/beginning of March on the strength of early February imports that are due into domestic ports roughly around this time. That should be followed by yet another drop in volume, as the shutdown of Chinese ports which began at the onset of the Lunar New Year on February 9th begins to impact import volumes. This will happen around March 7th — give or take a few days — and will last for two or three weeks, as workers are on holiday/returning back from holiday/ramping production back up following the Lunar New Year.

Watch This Week's Redwood Rundown

Each week Redwood’s EVP of Procurement, Christopher Thornycroft, shares his expert insights in the Redwood Rundown. In just a few minutes, you can gain a deeper understanding of the news and events impacting your business this week:

Carriers Are Trying to Stick It Out, But The Pain Is Increasing

Even as we achieve volume gains, however, there will still be excess capacity that has been reluctant to shake out.

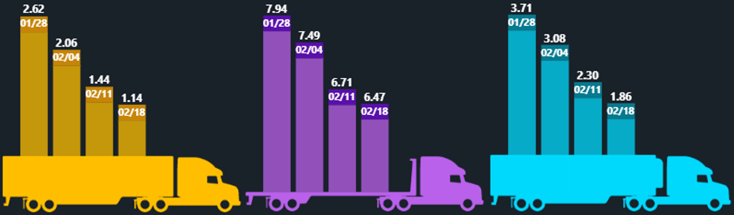

Buoyed by hopes created by January’s spot rates, carriers have attempted to entrench themselves to stay in the fight prior to a potential market shift. But losing -$.21 of RPM on spot freight in the last month has been tough to absorb. And, with incredibly low load-to-truck ratios (the DAT dry van LTT last week was 1.14 to 1), there is a natural race to the bottom to secure freight. This will continue to close the doors of more carriers, particularly smaller carriers without contract footprints.

There are reports that larger carriers have been attempting to negotiate rate increases directly with shippers to keep their capacity locked in through the year. While the response hasn’t been overwhelming, the sentiment seems to be that carriers who have operated with high service levels are getting a better shot at slight increases.

A Look at What’s Happening Nationwide

In market specifics, capacity is looser than it was at any time last year. There was not a single major Northeast market above 2:1 last week (Elizabeth, NJ 1.38/Philadelphia, PA 1.34/Harrisburg, PA 1.52/Baltimore, MD 1.94) — and all have come down since then.

The Midwest has an even weaker story to tell, with the Chicago market at a historically low 0.28 to 1 LTT. Minneapolis, MN (0.76 to 1) and Green Bay, WI (0.94 to 1) are also seeing low volumes. It should be noted that the Green Bay market still has an OTRI of 13.41%, which is the among the highest amount of tender rejections this market has seen since March 2022. Other Midwest markets with high OTRIs are Des Moines, IA (17.1%), Cedar Rapids, IA (17.61%), Dubuque, IA (15.72%) and Rock Island, IL (13.84%).

Southern California remains dormant right now (Los Angeles, 0.60 to 1) and will continue along that path until we see the import rebound begin to hit the ports. This will impact surrounding markets as well (Phoenix, 0.88 to 1). Also unknown at this time is the impact of recent severe rain on the Southern California produce crop, which was hotly anticipated due to the amount of rain received in 2023 — but washouts may push that timetable back significantly.

The Southeast is dormant and will remain that way until the beginning of April, gradually heating up from there. We predicted that this week we’d begin to see seasonal upticks in Texas volume. Houston, Laredo, and McAllen have all realized early increases in week-over-week (WoW) volume — but, as we also predicted last week, these markets still have ample capacity. Of the major Texas markets, only Laredo (3.4 to 1), McAllen (3.9 to 1), and Houston (2.3 to 1) have shown any real capacity tightening.

The markets we’re watching for volatility in the coming month (besides Iowa and the neighboring markets previously mentioned) would include Memphis, which was 3.5 to 1 last week. We’re also keeping an eye on the Arkansas market, as Wal-Mart has the ability to flex its muscles and change outbound volumes in that market very quickly.

Top 3 Charts for the Week

OTRI Trending Above 2023

Even in this chilly February market, the OTRI (Outbound Tender Rejection Index) is up 41% year-over-year.

The Load-to-Truck Ratio Continues to Drop

We’ve been watching the steady decline in the national load-to-truck ratio for a few weeks now.

Carrier Exits Continue

Carriers are hoping to stick it out until volumes increase. But in the meantime, exits continue.

Get Up to Speed with Weekly Market Intel

What’s going on this week in the US logistics market? Follow the Redwood LinkedIn page to watch Christopher Thornycroft’s insightful Redwood Rundown video every Tuesday. You can also read our insights blog to learn about industry trends and gain intel, including the weekly Redwood Report!