REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

The fourth quarter is not off to a positive start, thanks to the expanding United Auto Workers strike, the continuing exit of carriers from the market, increasing fuel prices and rising interest rates. While the US government shutdown has been averted for now, it still looms in the not-so-distant future as an additional threat. All in all, it appears that the market is taking at least a short-term sharp drop that will continue to push capacity out of the market, and it’s difficult to pinpoint a recovery time until there is resolution — as opposed to escalation — of the current autoworkers strike. Barring sudden changes, shippers should continue to see high levels of tender acceptance in the short term while keeping a close eye on the impact of the downturn on capacity levels.

Read on to learn more about how these trends have created a challenging week for the US logistics industry.

Every week Redwood’s EVP of Procurement, Christopher Thornycroft, provides his expert perspective on the US logistics industry in the Redwood Rundown. Take just a few minutes to learn more about the events and trends impacting your business this week:

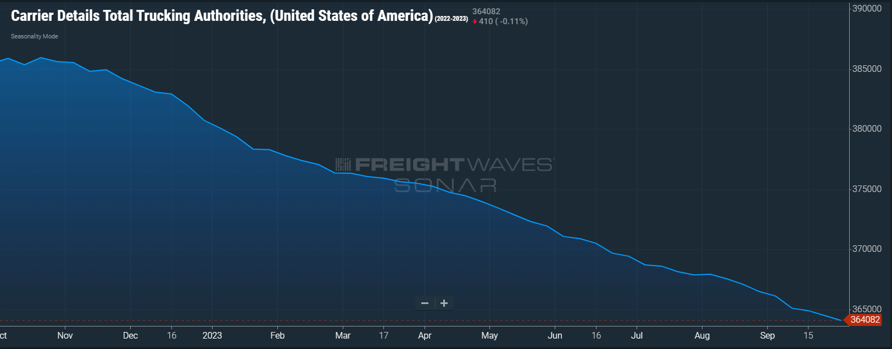

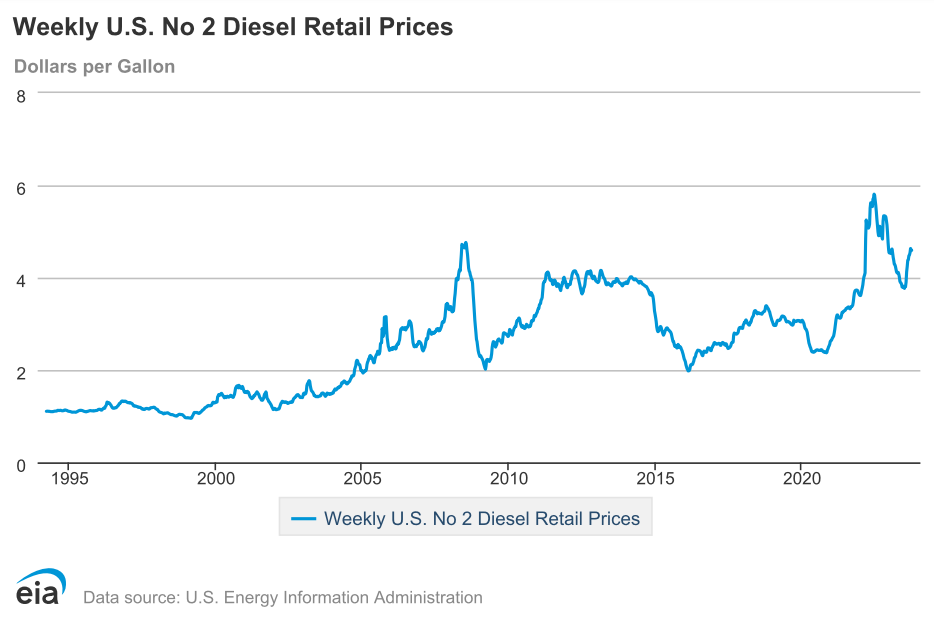

Tough times only got tougher for the US logistics industry with last Friday’s escalation of the UAW strike, which sidelined another 6,900 union members. The impact of this strike continues to drive declining volume postings across the Midwest and the Mexican Border, as all shippers in these areas have an excess of capacity fighting for their freight. At this point, the UAW and Detroit’s Big Three automakers appear miles apart, announcing additional furloughs of non-union employees since Friday. As the strike enters its third week, enterprise-level carriers turning to the spot market will find a significant loss of revenue, as the spread between spot and contract rates remains high at $0.49 a mile. As we have stated many times before, the smaller carriers are even more exposed in the current market due to the high cost of diesel ($4.593 a gallon) that eats away at their profits as they generally hold less favorable fuel programs. In September, we saw a loss of over 2,000 net carrier authorities and we expect the pace of net authorities lost to continue and accelerate over the coming weeks and months.

At the national level, negative economic headwinds continue to grow as well. Thirty-year fixed mortgage rates rose to 7.72%, the highest rates since November 2020. These rates are likely to rise even higher when the Fed announces further interest rate increases in an attempt to drive down inflation. This will continue to curb the housing market, which is in a downtrend already. New Single Family Housing Units Under Construction, an important barometer, are at their lowest level since May 2021 when we were in the midst of the pandemic. The absence of a robust housing market will continue to reduce the annual spending rate for durable goods, which had already declined by $6.2 billion from July to August. While we avoided a US government shutdown last week, which was a welcome development, even that piece of news comes with an asterisk — as it’s only been averted for 45 days. Soon we’ll be watching Washington D.C. prepare for a spending bill showdown all over again.

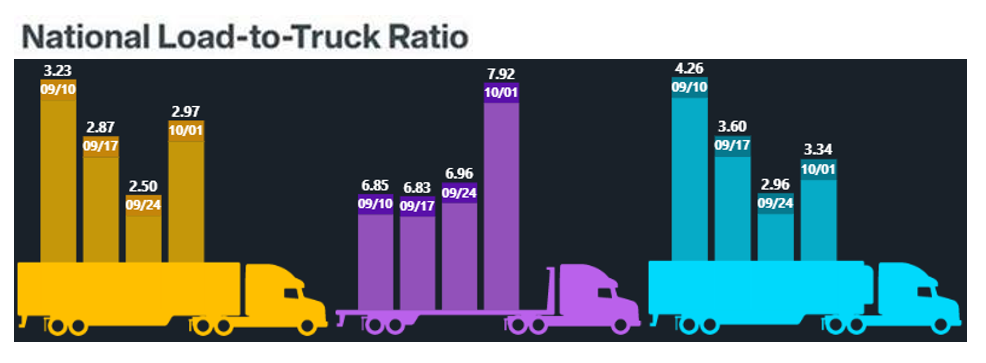

At the end of the third quarter, we saw an increase in the load-to-truck ratio from 2.50 to 1 to 2.97 to 1. But then we immediately saw shrinking volume postings across much of the country. Much of this can be attributed to seasonal effects, as October traditionally starts with a soft market — but the impact of the previously mentioned market factors is tough to ignore. The Pacific Northwest remains the tightest market in the country as Seattle (4.2 to 1) and Portland (6.0 to 1) have capacity pulled toward neighboring markets that are in the peak of their produce season. Los Angeles (7.7 to 1) saw volumes surge on Friday, but we’re already seeing signs of a returning shippers’ market out of the Inland Empire as retail inventories remain too high ahead of the holiday season. This is the Midwest’s peak season, but it doesn’t feel that way this week as Chicago (1.98 to 1) and the rest of the region see volumes deflate as a result of the UAW strike and enterprise-level carriers flooding the area. The East is seeing declining volumes from Elizabeth, NJ (3.4 to 1) to Baltimore (3.0 to 1). Down south, a shippers’ market remains in its seasonal lull from Atlanta (2.8 to 1) to Memphis (4.3 to 1), Dallas (2.4 to 1) and Laredo (3.6 to 1). Traditionally, all markets deflate at the beginning of October. Our outlook on imports for Q4 will remain cloudy until Golden Week ends in China (October 1–8), and we see what “normal” ocean booking behavior looks like going forward.

-2,155 lost authorities in September. Next week we will highlight an even more complete picture with the BLS updates to General Freight, Long Distance Truckload employment, but all indicators are suggesting the inevitable loss of capacity has began to accelerate.

Rising diesel prices are just one of the many challenges that both shippers and carriers are contending with.

Last week, the load-to-truck ratio increased from 2.50 to 1 to 2.97 to 1, followed immediately by declining volume postings.

Data used with permission from DAT Freight & Analytics.

Eager to learn about industry news and trends that affect your organization? It’s simple. Just follow the Redwood LinkedIn page and watch Christopher Thornycroft’s insightful Redwood Rundown video every Tuesday. And keep an eye on our insights blog to stay current with the weekly Redwood Report!