REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

The United Autoworkers (UAW) strike is finally behind us as the Big Three Detroit carmakers came to a tentative deal over the last few days. As production lines get moving again, carriers throughout the Midwest will get a much-needed shot in the arm in an otherwise muted start to peak season for the region. Unfortunately, the US logistics industry will be feeling the negative effects of the strike for a while. However, we’re seeing some positive trends, including some rate increases. We expect rates to continue to climb this month, with a big push coming the week after Thanksgiving. Early data indicates that the surge during the post-Thanksgiving period will be bigger this year, producing higher volumes than in 2022. Looking at regional trends, the end of October saw low activity across the US. Expect a generally calm November as well, but brace your business now for the post-holiday scramble.

Read on for more details on what’s happening now — and what’s to come.

Want to take a quick look at the events and trends that will affect your business this week? Watch the Redwood Rundown, where EVP of Procurement Christopher Thornycroft provides his expert insights:

Although the end of the six-week UAW strike is welcome news, the damage has largely been done in terms of the financial health of carriers. Sonar’s Total Trucking Authorities saw the 13th straight month of declines in October, after we experienced an oversaturated market in 2021. Much of the overcapacity in 2022 went to larger fleets with lucrative contract freight and competitive fuel programs. But now, in 2023, those same fleets are shedding capacity themselves. Those large fleets were hit hardest by the UAW strike, but — just as we witnessed during the last UAW strike in 2019 — we won’t see the impacts on employment numbers until late this year or early 2024. As the declining capacity of large fleets accelerates, routing guides will be susceptible to failure, creating spot markets that will push the market into its next phase. This will take several months as all providers will look to hold onto still-valuable contract freight over the holidays, but will be challenged by an ever-shrinking pool of capacity.

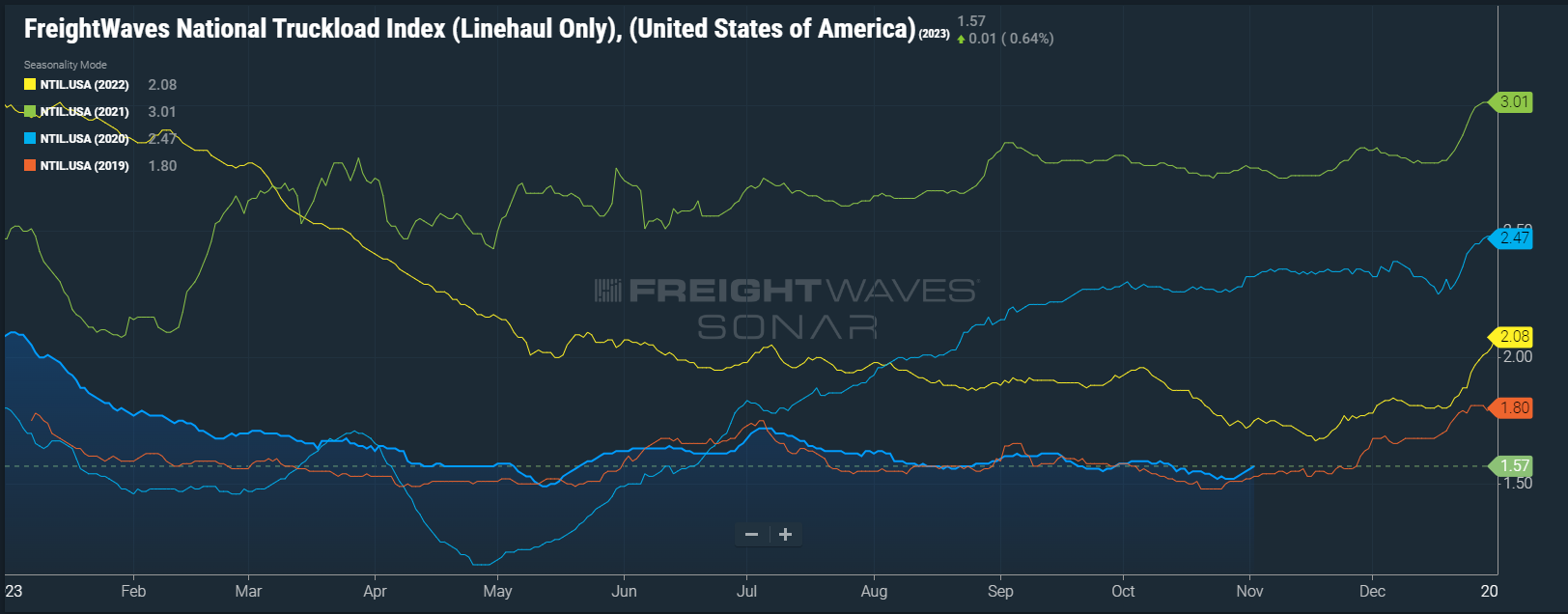

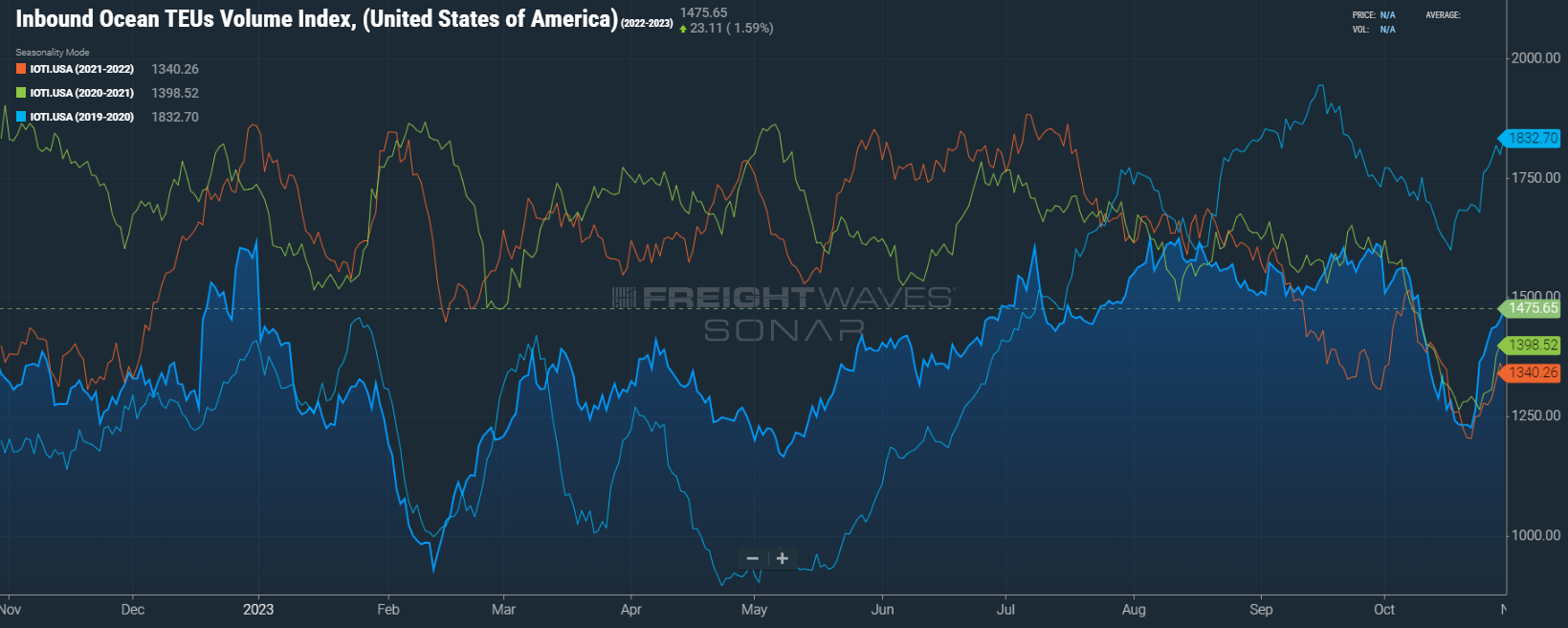

With the combined impact of Convoy shutting down and the announcement of the UAW strike ending, we’ve seen rates bump slightly higher as Convoy’s freight is reabsorbed into the greater network and inevitably repriced higher. At the same time, national carriers are no longer desperately plunging into spot boards and driving those rates down. The Sonar National Truckload Index (NTLI) is reflecting this change in the environment, with rates up from a low of $1.52 (LH) on October 28 to $1.57 on November 3. It should be noted that the NTLI was at $1.62 on September 14, the day before the strike began. Given that November is seasonally soft, with weak freight volumes until the late-month uptick, we anticipate that rates will continue to rise, but slowly — until that week after Thanksgiving delivers a large push. That late-push theory is currently being proven with the data we’re seeing for imports (see the IOTI data below), which are trending up against this same period in 2022 and 2021. This suggests a larger surge of freight on the back end of the month than we saw in 2022 at least. Generally rates rise through the close of the year due to drivers parking their trucks for the holiday. We anticipate more of the same this year, as low rates will not give drivers an incentive to roll at negative returns.

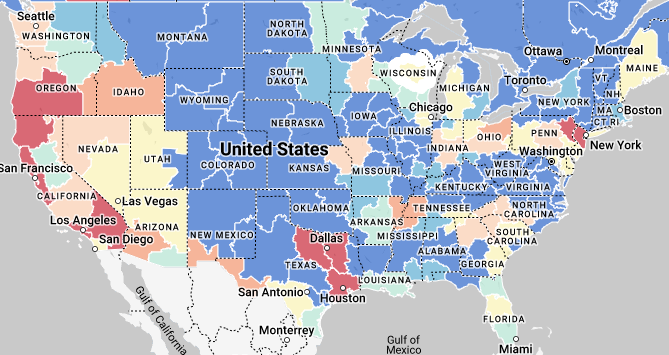

In market specifics, we saw a very muted end-of-month for October, as shippers have market power throughout much of the country. In the Southeast, volumes are in their seasonal basement from Atlanta (1.4 to 1) to Miami (1.4 to 1). Northeast volumes continue their decline, with volumes in the basement from Elizabeth, NJ (2.0 to 1) to Buffalo (2.5 to 1) and Philadelphia (1.9 to 1) to Baltimore (2.0 to 1). In the Midwest, the depressed volumes are a direct result of the UAW strike, as this is the region’s peak season. Look for volumes to rise from Chicago (1.1 to 1) to Detroit (1.3 to 1) and from Cedar Rapids, IA (2.9 to 1) to Minneapolis (2.7 to 1). In the Mid-South, volumes should begin to pick up slightly from Mexican auto imports (Laredo, 2.1 to 1) while Dallas (1.9 to 1), Houston (3.6 to 1) and Memphis (2.0 to 1) remain backhaul markets. On the West Coast, we see volumes relatively flat out of Los Angeles (5.2 to 1), San Francisco (3.4 to 1) and Phoenix (2.0 to 1). In the Pacific Northwest, Seattle (2.3 to 1) and Portland (2.7 to 1) remain in their peak season, along with mountain markets such as Salt Lake City (3.5 to 1).

Looking ahead to the month of November, the lead-up to Thanksgiving should be largely quiet outside an inevitable heat-up in the Midwest. Look for Iowa, Minnesota, Wisconsin, the Dakotas and Illinois to tighten in the weeks ahead. Across the country, the week of Thanksgiving will be relatively low-volume as shippers close early for the holiday and carriers look for the freight that will get them home. Lanes that are major-metro to major-metro will likely move cheaper than normal because of this, but any freight heading to rural markets will skyrocket the week of Thanksgiving. The week after will bring one the tightest markets we’ve seen this year, as carriers are out of position, paper rate-routing guides fail, and shippers scramble to fill orders that slowed down over the long weekend or are needed ahead of holiday shopping.

The Sonar National Truckload Index (NTLI) reflects the fact that rates are beginning to rise following the UAW strike resolution.

Import volumes are up compared to 2021 and 2022, indicating that the post-Thanksgiving surge may stronger than the current market would suggest.

November’s starting with a cool outlook nationally, but things should heat up significantly at the end of the month.

Learn about the market trends impacting your business by following the Redwood LinkedIn page to catch our Redwood Rundown videos every week. And keep monitoring our insights blog for these weekly deep dives!