REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

With major developments on the U.S. east and west coasts this week, there’s plenty to cover in this week’s update, but we start with the breaking news that the ILWU (International Longshore and Warehouse Union) has reached a tentative agreement to a 6-year contract (coverage in JOC and FreightWaves) that would cover all 29 ports on the U.S. Western Coast.

How much freight that had been diverted to East Coast/Gulf Coast ports will come back to the West Coast ports remains unknown, as some of the freight may not return. Of course, the deal still needs to be formally ratified by both parties, but if it is, it will certainly be welcome news to West Coast carriers, as it means that import volumes on the West Coast will no longer be suppressed by port labor uncertainties. The looming cloud lifts just in time to avoid greater peak season chaos.

Other factors that could affect the West Coast such as the long-term impact of AB5 have still yet to play out, as the West Coast has not gone through a sustained boom market since the rule was implemented. We’ll keep our eyes on how the market unfolds out west, but there are plenty of other developments to unpack in this week’s market update.

The big news coming into the week was Sunday’s I-95 bridge collapse in Philadelphia, which was the primary topic in this week’s 2.5-minute Rundown with EVP of Procurement Christopher Thornycroft. Get the high-level overview before we dig into more detail:

Interstate 95 is the main north-south highway on the East Coast and is one of the primary freight corridors in the Northeast. A driver lost control of a gas-filled tanker, which caught fire under the I-95 bridge in Philadelphia, causing the northbound lanes to collapse.

The Pennsylvania Department of Transportation is reporting regular I-95 updates on its website, including that demolition of the damaged portion of the bridge has already been completed ahead of schedule, and state Administration, engineers and contractors have developed a plan to reopen the roadway safely and quickly.

For now, the short-term impacts will be creating additional miles for drivers and forcing carriers, load planners and owner-operators to re-evaluate the most efficient route for shippers traditionally served by that portion of I-95. As with any acute disruption, impacts will be localized at first, with a ripple effect carrying into next week that will be interesting to watch in terms of any tightening capacity in what’s been a muted market like many in the north.

We did see some signs of relief with the release of the latest CPI, showing year-over-year inflating moderating from 4.9% in April to 4.0% in May. The fresh data offers the latest evidence that the Fed’s push to control rapid price increases is beginning to work and hopes that continued financial tightening will begin to ease. Contributing to the decline are energy prices, lead by oil, which is currently trading near two-year lows.

Interactive chart from BLS website

Freight volumes dropped from 11,463 last week to 10,763 this week, representative of softening throughout nearly every market since Memorial Day. Now two weeks out from the Fourth of July holiday, with it landing on a Tuesday this year, it will pose difficulties to routing guides as transit times and driver repositioning will take the full week to be corrected.

Data shared with permission from FreightWaves

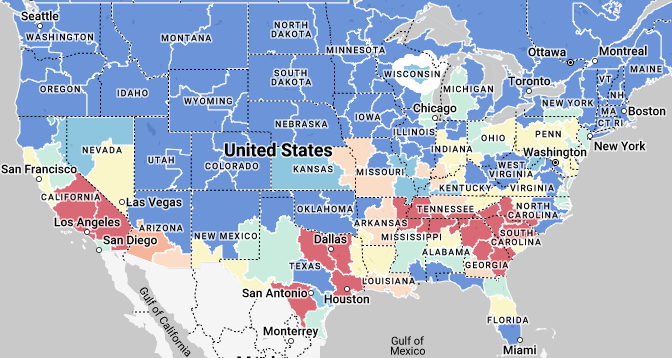

The only region that has remained difficult is Texas, led by Houston (8.9 to 1 load-to truck ratio) and Dallas (6.8 to 1), and to a lesser extent Laredo (7.9 to 1), McAllen (13.1 to 1) and El Paso (6.2 to 1). The Southeast is still in the midst of produce season, albeit a historically weak one. Arizona is still experiencing some high volumes (Phoenix 6.7 to 1), though Southern California volumes have moderated over the last few weeks (Los Angeles 4.6 to 1).

Data adapted into map format with permission from DAT Freight & Analytics.

Even with the currently muted market pressure, the 12-month crystal ball continues to show capacity exiting the market due to rate pressure. While demand concerns remain extremely relevant until inventory levels have been significantly reduced, and capacity remains strong year over year, continued price reductions in transportation and a still strong labor market will begin to show the strength of competition for driver jobs, inevitably setting up an undersupplied freight market that may be a familiar change.

How are all the major freight markets doing? How will the ILWU tentative agreement impact import/export patterns? When will I-95 re-open? We'll keep tabs on all of it, so stay tuned and we'll keep you in the loop.

Follow the Redwood LinkedIn page to catch our Redwood Rundown videos on Tuesdays, plus coming soon you’ll be able to sign up for exclusive deeper weekly market insights via email on Wednesdays. And keep checking back to our insights blog for these weekly deep dives as the week winds down.