REDWOOD LOGIN

Redwood PortalLTL

SCS

SCS Support

Rockfarm

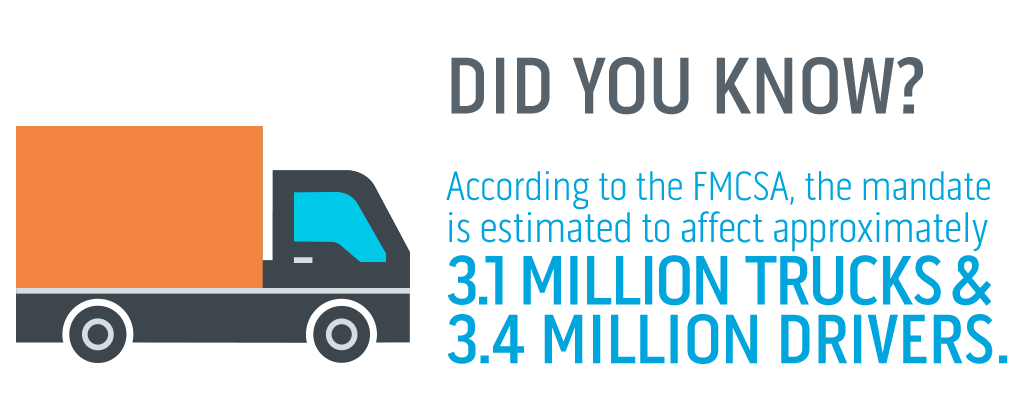

In December of 2017, the Federal Motor Carrier Safety Administration (FMCSA) began enforcing a new law that completely altered the trucking landscape for the foreseeable future.

The FMCSA approved the Electronic Logging Device (ELD) mandate, forcing all full truckload (FTL) and less than truckload (LTL) carriers to use an electronic device instead of paper logs to keep track of their drivers’ hours of service. Safety was the FMCSA’s concern when pushing for the ELD mandate as some drivers were forging their paper logs and driving longer than legally allowed. The idea behind this mandate was to make sure hours are being tracked correctly, which would result in more rested, alert drivers on the road.

It has only been a few months since the ELD mandate went into effect, but carriers and shippers are already seeing major changes from their old shipping routines. In this article, we’ll take a look at how the ELD mandate is affecting delivery windows, prices and capacity for both FTL and LTL.

The shippers and receivers relying on FTL and LTL freight movement have had to adjust their expectations for on-time deliveries. Before the ELD mandate, many dedicated FTL carriers could push their trucks to make up to 700-750 mile runs for next-day delivery. These drivers could not legally make that type of run with their allowed hours of service but with paper logs, it was easy for them to cook the books whenever they needed to.

In most cases before the mandate, if a driver was within a couple hours of his delivery point but did not have the hours to make it, they would keep driving and fix their logs later. With the ELD mandate in effect now, drivers do not have that option. The ELDs required by the FMCSA need to be synced with truck’s engine to record drive segments. Once the truck is turned on and starts moving, the driver’s hours of service will begin in the ELD.

Drivers are now stuck to their hours of service without a way around the ELDs. With the ELDs tracking every second of the driver’s time, now most carriers can only make next-day deliveries on shipments around 500-550 miles at most. Shippers have had to adjust by getting the product ready a day earlier than normal on longer shipments to give the drivers more time to make on-time delivery.

Early on in the ELD era, carriers and shippers are both seeing a rise in pricing for LTL and FTL shipping. Drivers cannot stretch their hours like they could before and because of this, they cannot take as many shipments as they used to. Both LTL and FTL trucks are being tied up for longer periods of time and the increase in prices reflects that.

FTL carriers are charging more because there isn’t time for their drivers to start on their next shipment since the clock is still ticking when the driver is sitting at the delivery dock getting unloaded. LTL carriers are upping their prices per pallet space because they don’t have nearly as much time as they used to have to get from shipper to shipper to load enough product to fill their trailer. Shippers can expect a price increase of anywhere from 5-10 percent, with spot shipping possibly going up, even more, depending on what capacity looks like.

Before the ELD mandate went into effect, there was a lot of resistance from carriers. A lot of owner-operators threatened to call it quits if the mandate went into effect because of the cost associated with installing an ELD into their trucks. Many also saw this mandate as an invasion of privacy since this electronic device will track their every movement in the truck at all times.

Now that the mandate is in effect, some carriers have parked their trucks while the working carriers are tied up for longer periods of time, so capacity is tight across the country. Regardless if shippers are moving freight LTL or FTL, the truck availability is down even in areas where truck markets are historically loose. The low capacity is also driving up rates as shippers fight over the few carriers available in the area.

The ELD mandate has been active since mid-December, so shippers and carriers have both had to make adjustments to ensure their LTL and FTL shipments have enough time to make on-time delivery. Shippers have already felt the capacity crunch and are paying more for their logistics as a result. The capacity and market should eventually level out once this becomes the new normal, but neither carriers nor shippers are quite sure when that will be. In the meantime, expect longer transit times, higher rates and tighter markets.